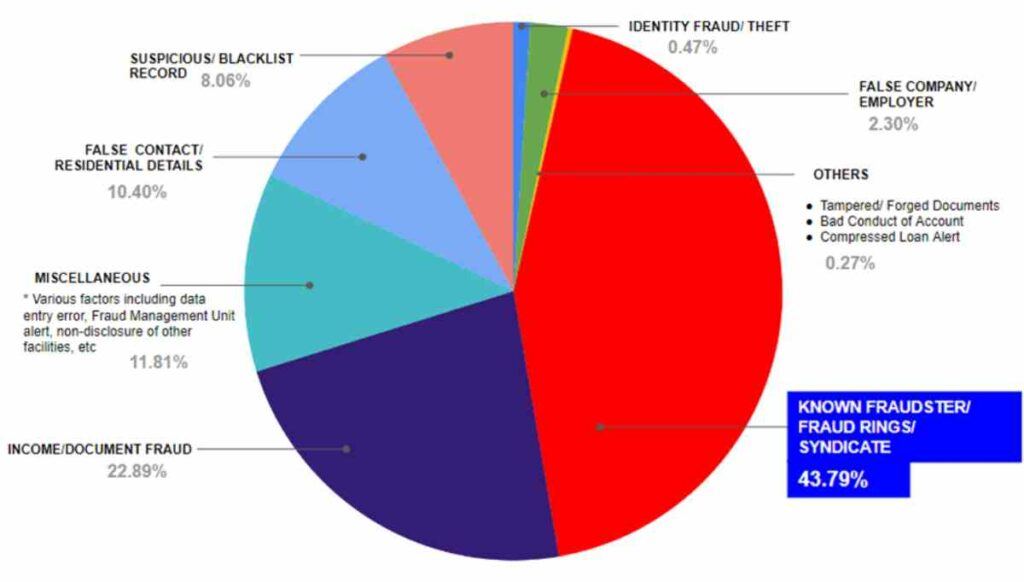

KUALA LUMPUR, 28 May 2024 – National fraud bureau, CTOS IDGuard, has released latest statistics showing that 44% of all flagged credit applications from member banks are attributed to syndicates and fraud rings.

Fraud Types and Reasons identified by CTOS IDGuard

The data released is captured from 9.44 million applications over the past 45 months, with a total of RM519 million in potentially fraudulent applications being flagged by the system to alert banking consortium members since September 2020. This is a 62% increase compared to the RM319 million from the 36-month result published nine months ago.

CTOS IDGuard is part of CTOS’ suite of fraud and identification services which leverage on CTOS’ unique and extensive database, such as CTOS eKYC, CTOS Multi-face ID and CTOS Digital Footprint. To date, CTOS IDGuard covers over 65% percent of Malaysia’s banking assets.

“Over the past year, we have been using machine learning to increase the efficiency of the CTOS IDGuard Fraud Bureau. The latest figures have shown that this has improved detection rates by over 6% and is likely to be an important tool in the fight against known fraudsters and syndicates,” stated CTOS Digital Group CEO, Erick Hamburger. “These latest improvements are vital for the sector and our economy as digital finance continues to grow.”

Also Read: Transforming Digital Landscapes: An Interview with Michelle Phang and May Lee of OpenMinds Digital

GBG, the provider of CTOS IDGuard’s fraud and financial crime prevention engine, who have worked hand-in-hand with CTOS since IDGuard’s inception, also concurred.

“Criminal networks continue to become more organized and sophisticated, making it challenging for financial institutions to detect fraudulent activities,” added Carol Chris, General Manager, APAC at GBG. “Together with CTOS, we are dedicated to safeguarding member banks by giving them data intelligence to make the best decisions about their customers, when it matters most.”

About CTOS Digital Berhad

CTOS Digital Berhad is the holding company of CTOS Data Systems Sdn Bhd, the leading Credit Reporting Agency in Malaysia. It also has 24.825% stake in Business Online Public Company Limited (BOL), the leading credit information and risk management provider in Thailand. Founded in 1990, the Group offers a broad suite of innovative digital products and credit risk management solutions and services which gives it a solid platform to thrive not just in credit reporting, but also in digital credit decisioning across Southeast Asia.

With a broad suite of innovative products and services developed in Malaysia over the company’s 30-year history, the Group’s digital solutions are widely used by the country’s banking and financial institutions, insurance and telecommunication companies, large corporations, SMEs, legal firms, statutory bodies as well as consumers for self-checks.

The Group provides solutions across three core customer segments – the Key Account segment, which includes a significant number of leading financial institutions and corporates; the Commercial segment, which includes a growing number of small-and-medium-sized businesses; as well as over 2.2 million individual customers registered with CTOS ID in its Direct-to-Consumer (D2C) segment.

CTOS Digital Berhad’s mission is to empower individuals and businesses with the confidence to make sound credit decisions through access to data and insights at greater ease and speed, leading the community to better financial health. While its vision is to make Malaysia a centre of excellence for credit reporting in ASEAN.

About GBG

GBG is the leading expert in global digital identity. We combine our powerful technology, the most accurate data coverage and our talented team to deliver award-winning location intelligence, identity verification and fraud prevention solutions.

With over 30 years’ experience, we bring together a team of over 1,250 dedicated experts with local industry insight from around the world to make it easy for businesses to identify and verify customers and locations, protecting everyone, everywhere from fraud.

Learn more at www.gbgplc.com and follow us on LinkedIn and Twitter @gbgplc.